“The slickest way in the world to lie is to tell the right amount of truth at the right time-and then shut up.”― Robert A. Heinlein

Detecting Lies and Half-Truths

I have a knack for evaluating a person’s character quickly and accurately. A friend of mine calls it a unique sixth-sense; an uncommon ability to recognize the truthfulness and sincerity in a stranger’s words.

I can read body language like a psychic reads tea leaves or a palm reader examines the lines in your hand. I recognize the subtle physical clues others can’t see or choose to ignore.

The truth often reveals itself through unusual hand gestures, facial expressions, vocal changes and eye movement. In person it’s easy for me to spot the discrepancies between baseline behavior, (what’s normal in non-threatening conditions), and the atypical body language of someone who is acting dishonestly.

This works great when I meet someone face-to-face, but unfortunately it has no relevance in today’s digital world. These days we are masked by the Internet. We are hidden behind computer screens where facial expressions and body language are no longer visible to those with whom we communicate. We coexist in a binary, data-driven society that provides zero clues about our honesty. It enables us to invent things like ‘fake news’.

As I sit in front of my computer screen I can’t observe the emotions and mannerisms of the story tellers weaving their tales. None of us can, so how can we distinguish fact from fiction? Are we being told the truth, a partial truth or an out-and-out lie?

How often are people honest on the Internet particularly when it comes to money? How often do you believe the presented facts and how often do you question them?

Are we Being Honest or Crafting an Illusion?

As a personal finance enthusiast I’ve read a lot of blogs about money, income, success and failure. As a blogger I’ve written over 1700 posts on those same topics. I’ve used this blog as a online financial journal of sorts. The story began a few years after graduation and has continued, (except for a short hiatus), for more than thirteen years.

All along the way I took pride in my honesty and integrity. I told the story to the best of my ability. This is my truth, or so I thought, but as I read the words of others I’m not so sure.

As personal finance enthusiasts and bloggers are we telling the whole truth or are we inadvertently crafting an illusion of what we’ve accomplished and who we are?

Money Lies

In 2018 the National Endowment for Financial Education (NEFE) conducted a survey about financial infidelity. Forty-one percent of respondents admitted to committing financial deceptions against their partners and spouses. Two in every five respondents admitted to being dishonest by hiding purchases, bank statements and cash or lying about their debt and income.

If we can’t be honest with those we love it’s pretty easy to assume we aren’t telling the truth online either. It takes little to no effort to alter financial figures or create fictitious net worth charts and diagrams.

As an anonymous blogger I can weave my tale any way I choose. So can every other blogger out there. Some tweak the truth purposefully while others do so unintentionally or even accidentally.

We can compel readers to trust our words all the while misleading them about our background and history. We can twist the story to tout our success or make our journey appear more difficult than it actually was.

Let me provide you with a few examples.

Real Estate Half-Truths

I recently met an eager twenty year old who tried to sell me on the art of real estate investing. “I earn $12,000 a month buying, selling and renting houses.” he said with a wide grin.

“$12,000, before or after taxes?” I ask. His grin begins to fade ever so slightly. “Before taxes,” he says.

“So you earn “$12,000 every month buying and renting houses?,” I ask. I stress the word “every” because I am genuinely interested in the details and $12,000 is a decent chunk of change, particularly for a twenty year old.

“Oh, well not every month,” he says, looking down ever so slightly. “Actually August was a very good month.”

Now let’s be clear. This personable young real estate investor wasn’t lying. He probably did earn $12,000 one month, but that doesn’t mean he earns $12,000 every month.

He’s mostly telling the truth, right? So what’s my complaint? After further discussion this enthusiastic young man told me he earns closer to $8,000 per month. There is a world of difference between $12,000 and $8,000. In fact, the difference is $48,000 per year.

Manipulating the Numbers

Honestly, I don’t even know if $8,000 a month is accurate. How long has he been earning that income, how much does he pay in expenses, HOA fees, repairs, property taxes, etc?

When we talk numbers we can manipulate the data. What this guy earns from rental income and sales is only piece of the entire puzzle. There are many expenses and headaches involved in owning real estate. He didn’t mention any of those as he tried to sell me on his ideas.

In isolation we can make our numbers look unbelievably impressive. We can convince other people that we are successful. We can also convince them to buy our products, click our links and follow our advice.

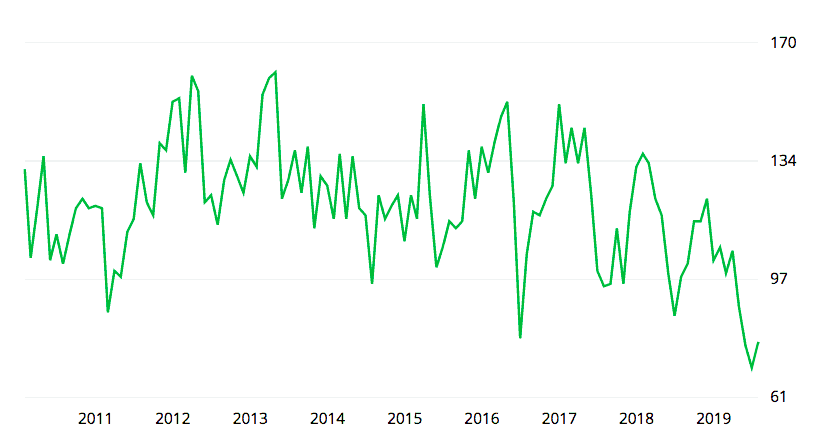

This real estate investor told me housing prices never go down in the city where he’s buying, but a two second Google search proves he’s wrong. Is he ignorant of the facts or purposely trying to mislead me?

Blogger Exaggerations

Here’s another one for you. I recently met a blogger who told me he earned a LOT of money from advertising revenue and affiliate links. I think that’s pretty cool. I’ve never looked seriously at making a profit off of this blog, but kudos to those of you who can make it happen.

In fact, I’ve been writing this blog since 2006 and my sidebar earns me a whopping $40 a month if I’m lucky. (As someone pointed out I must own a very unpopular blog. That guy wasn’t wrong.)

This blogger told me his website earns $100,000 a year. That sounds super impressive, right? But don’t get too excited just yet. A minute or so later a few more details emerged. It turns out the website is run by four people. So run that math and this guy earns closer to $25,000; probably before taxes mind you. Yup, the numbers look a whole lot different when you divvy them up, don’t they?

Did the blogger lie to me? No. His website brings in $100,000 a year, (that part may be true), but at first glance it seemed like he earned that income all alone. Again the facts in isolation appear so much better than reality.

Monthly Expense Omissions

Here’s another great example. Have you ever had someone tell you they spend a ridiculously low amount to live in a high cost area.

By the way I give mad props to anyone who can do this. I lived in a group house with six people after college so I could afford to live in the city. It’s possible, but it’s certainly not easy. I recently met a few people who told me they spend less than $1,000 a month to live in Washington, DC. That’s crazy low!

After two or three questions I found out one person lives in his parent’s basement and the other has a live-in-boyfriend who earns a high salary and pays the majority of the bills.

Hmmm, those details don’t make the initial claim nearly as impressive, do they? We can create very interesting stories about ourselves by leaving out important facts.

Financial Independence Claims

How about those amazing stories of financial independence? I read so many of them. Incredible stories about people who save 25 times their annual expenses. Good for them. That’s amazing! But you know what? Before you try to follow in their footsteps you need to ask for more details.

A single guy living in Kansas might need $1500 to live comfortably each month. A family of four living on the East Coast might need $6000.

Has the guy from Kansas saved 25 times his expenses? Yes. Has he met the definition of financial independence? Sure. Has he lied? Most definitely not, but my own life circumstances couldn’t be any different from his. I might as well live on Earth while this guy lives on Mars.

Let’s be clear. I’m not diminishing his feat or saying the claims aren’t true. I simply think we need to review the details so we can understand the full picture.

It’s important to know how we are similar and how we differ, so we don’t step up to the plate and feel like a failure when we can’t meet the same FI goals.

Early Retirement Police

Oh this is a tough one.

You know those early retirement police? Yeah you do. The ones who say you can’t claim early retirement if you are still earning an income? Have you ever wondered why they make that claim? Because it feels like a lie to them.

I’m not saying it is a lie. I’m saying it feels like a lie to them. Their old-school definition doesn’t fit with the new way of thinking about optional retirement. So they literally read a post and think, “That’s BS. Stop claiming you are retired!” They feel they are being lied to.

You can agree or disagree with their sentiment. Personally I don’t think it matters if you enjoy another job after leaving your traditional one, but I can see why readers feel betrayed when they follow the rabbit hole of an article they feel mislead by.

Failing to Recognize Spousal Support

Or how about this one? Is it fair for a blogger to say I think we should all follow our passions if his wife is working in a job she hates? Should a blogger say we should work part time without acknowledging that his or her spouse works a full time job?

Is it fair to say we should move on to a more meaningful life, but fail to mention our partners are filling in the financial gap we left behind? We all know that both spouses can benefit when one leaves the workforce or cuts back on hours, but should we explicitly point out our ability to make those decisions because of our hard working partners? Partners that may not enjoy the same benefits of those who have left work behind?

My Own Half Truth

Why am I dredging up all of this stuff? Why does it seem like I’m pointing out so many lies and half-truths and even truths that are simply misinterpreted by the people that read our posts?

After all these years I’m not sure I’ve made my own story 100% clear. I haven’t purposefully left out any vital details, but I do think I’ve failed to highlight certain facts.

For example, I’ve written a lot about the money my husband and I saved prior to the time my children were born. I’ve also written about quitting my high paying job as a result of those savings.

It’s true that we were millionaires by the time I walked away from work, but it’s also true that I wouldn’t have quit my job if my husband wasn’t still employed. Have I made that clear to my readers? I’m not sure.

Am I leaving out a part of my story if I fail to discuss the importance of the money my husband currently earns? Yes, most definitely! My husband earns a six figure salary as a software engineer. That is an important part of our financial journey; perhaps one of the most important parts of all.

I recently discussed my thinking with a fellow blogger, Angela, from Tread Lightly Retire Early. She told me I was being too hard on myself. “I think your readers know that your husband earns a lot of money”, she said. But, honestly, I don’t know if they do. I don’t repeat the details in post after post. If you haven’t read my story from start to finish are you missing important details?

Have I presented this story as an amazing version of my accomplishments without providing enough kudos to my hardworking financial partner? After all I called this blog “One Frugal Girl” not “A Couple That Is Really Good With Money.”

Why Does It Matter?

Why does it matter? It matters because there are readers out there consuming our content. There are people on the street reading our stories and wondering if they can do the same things we do.

Amazing people are trying to replicate the stories we write about. Can they do it? Are we honest about how easy or hard it is to achieve the same goals?

Are we telling a half-truth, leaving out details or providing enough information for the rest of the world to see all of the facts.

If I inherit a million dollars I am a millionaire. If I go to college, get a high-paying job and save my money I can become a millionaire. But these two stories are very different.

Now what if my parents paid for my college expenses and I graduated debt free? Or what about the student who completes school with debt then pays it all off to become a millionaire? What about the high school dropout who builds a company from the bottom up and becomes a millionaire?

These are all different stories that can be spun in various ways. I am not trying to discount any of the hard work and effort that went into those journeys, but certainly some are more impressive than others. And keep in mind that all of those stories are impressive to the people who lived them.

The Stories We Tell

What’s my point in all of this? Well, without all of the facts some stories aren’t as interesting as one might lead you to believe.

As bloggers we need to be aware that readers look to our stories for inspiration and guidance. I owe it to myself and to those who stumble across the path of this blog, to tell the truth as openly and honestly as possible. I’m just not sure how to do that or if I already have.

We are not all starting from the same point, earning the same amount of money or saving the same proportion to build our wealth. I think it’s important to provide the facts to the best of our abilities and to hope that our readers ask questions of the details we provide.

—–

If you are interested in learning more about spotting lies check out this amazing talk by Pamela Meyer called “How to Spot a Liar.” It won’t help you on the Internet, but it provides valuable and disturbing insight into spotting lies in the real world.

This is exactly why I jumped on board and wrote out a Transparency page for my blog. I think I’m pretty clear no transparent for anyone who reads my blog regularly, but a post taken in isolation might not tell that story. The same is true for you, I think. Since I’ve read your story for so long, the comment about your husband feels like “or course,” but it might not be so clear to a casual reader who has only recently stumbled on your blog.

I think it’s time to finally type up an about me page. It’s been on my to-do list for a really long time, but for some reason I never seem to get around to it. I like to think everyone who reads my blog reads a lot of my posts, but in isolation I’m not sure if the story is as clear as I want it to be. Thanks for making me feel like I haven’t ‘left out’ the important parts even if I can’t include them on each and every page.

Ha, I make the same assumption about blog readers. If I wrote it, surely they have read it, right??

But of course, that is not always true.

Google is full of one and done readers. I guess part of the issue is who am I writing for? I can assume my regulars know my story, but what about the folks that stumble onto only one post. Is there a way to share the details? I guess that’s what I’m struggling with.

I’m pretty sure we knew that your husband is the current breadwinner and that you quit because he was still employed / earning AND you had savings, not JUST because you had savings. At least that was clear to me, but as Angela says, maybe that’s because we’re regular readers.

Also at $40 a month, you’re beating the pants off my blog! XD

Also? Now I want to know those conspiracy theories.

Ditto what Revanche said. And generally knowing what industry someone works in gives an idea of their income (I did know he was also in tech).

One thing I hate is when people say “I went from $XX,XXX in debt to a “$200,000” net worth in X months/years! That means NOTHING! You could be in huge debt but still have a positive net worth. Unless you actually say ‘from X net worth to Y net worth’, this is a useless thing to tout but it sounds great on Twitter/Pinterest.

@NZ Muse – I 100% agree with this. I also think you have to provide all of the facts, because that changes the narrative. If you earn $500,000 a year it’s not difficult to pay off that much debt. If you earn very little it’s a much bigger feat. The power is in the numbers and what you do or do not include when talking about them!

@Revanche – It’s tough to figure out how to include the key points of our story without repeating myself in each and every post I write. I’m going to update my about me page and see if that makes me feel better about the whole thing. There are definitely folks out there hiding the truth and I don’t want to be one of them. Thanks for letting me know my ‘regular’ readers know the whole scoop.

As for the blog income it recently jumped thanks to a few popular articles and a tweak by BlogHer to give me a little more money for some reason 😉

Regarding the conspiracy theory Stephonee had a very compelling argument about a certain PF blogger who doesn’t seem genuine and whose numbers seem to prove he’s not as successful as he claims to be. You’ll have to come to the next FinCon so you can ask her about it 😉

I try to cover all that stuff that would be redundant in day to day posts in my About Me page, though it could probably use an update. I don’t specifically call it a Transparency Page but that’s what it is, along with a summary of the last 12 years or so. 😀

I need to keep a little book of all the reasons I should go next year! XD

Thank you for writing this. I found the post extremely helpful.

I’m brand new to blogging and have been reading a ton of different material lately. However, the more I read, I’ve been noticing some inconsistencies with blogs that has been concerning me. When you invest so much of your time in a blog and respect that writer, it can be disappointing when you feel some parts of the truth have been held back.

This is a great reminder to take everything with a grain of salt.

Thanks for commenting and congratulations on starting your own blog! It’s definitely difficult to tell the whole story every time you write a post. Regular readers know my story well, but those who stumble upon this blog won’t know all of the facts just from reading one post. I try to share as much as possible. In fact, it’s why I chose to blog anonymously. I knew there were some details I couldn’t provide if I gave my real name. Still I feel that in isolation, (reading just one post), it can be difficult to put all of the pieces together.

It is a little tricky to know a blogger’s whole story from just one post. That’s why I try to link back to previous posts that provide more backstory (when possible). I’m pretty sure most of your loyal readers know your story!

For me, I don’t feel like I can include the “whole truth” in my posts. Weirdly enough, it’s because I’m not completely anonymous, I feel like I can never give actual numbers. Somehow, with just strangers on the internet, I’d probably be okay with them knowing. But I have friends and family who read my blog and I feel awkward if they knew my actual numbers!

I totally agree about anonymity. Even blogging anonymously I don’t include all of my financials in case someone I know stumbles upon it. Oh there are a lot of family members that should not know all of the facts. I don’t think it’s as much about specific numbers as it is about talking through the ‘privilege points.’ You know stuff like: I went to college, I earned a six figure salary, my husband earned a six figure salary, etc. If we were multi-millionaires on a teachers salaries well that’s a whole different story.

I’m very honest in my blog about having been a single income family with me being a high earner. Admitted my three kids got free college, and about recieving a one million dollar inheritance after I was already a multimillionaire. I also admit I earn six figures working one day a week at my consulting hobby job since retiring. So I don’t blog on my nonmonetized site about becoming FI on a median salary, or about making money blogging. I just blog about living in a low cost of living area, driving old cars, staying married and how to have a fun and way overpaid career. Also about things my millionaire and billionaire friends have taught me. I just think you have to limit your scope to things you have lived or are learning about, then you can be honest. On the other hand I change names, places and lots of other things in my posts to protect my and my subjects anonymity. And I never reveal my net worth. And sometimes you have to compress the actual time line of real events to get novel length stories into 1500 words!

Hi Steveark, thanks for the comment. I totally agree on the compression issue. Plus, for many long time readers the details would be boring and repetitive. I also agree that you have to write about the things you know about. Of course, I’ve been writing for so long that I’ve touched on a whole range of topics and at 27 we were in a much different place financially then we are thirteen years later. Maybe that is the testament to this blog. That it’s been around for so long you can dig around and figure out all of the details from start to finish. I think your point of view is extremely clear. I didn’t have to read too many posts to figure out how you earned your money and in general terms how much you’ve earned.

When I was reading your post, what came to mind is my reaction to some tiny house people. I’ve watched a few shows, and I felt like they were leaving some stuff out.

(Such as the fact that they use the shower and toilet at the main house where they park their tiny house.)

I don’t think tiny houses are a terrible idea, necessarily, but I do feel like some people were presenting them as having a lighter, smaller footprint than they really do.

I see this happen in the zero waste movement as well. When you buy an item in bulk, it’s not exactly zero waste, because the bulk store got the item in a package in the first place. Again, bulk buying is a good idea, but it’s still not entirely zero waste.

Oh that’s a great analogy. Our friend is considering living on a boat, but he uses onsite facilities to shower and go to the bathroom. Quite frankly he doesn’t want to clean out the tank on the boat every week! And you are correct about zero waste too. Just because you push the packaging off to someone else doesn’t mean it disappears entirely. It’s easy to leave ‘stuff’ out in order to make the story look more interesting.

Thank you for this post. Between the clickbait headlines and the need to appeal to a wide audience often times facts are conveniently omitted. Whether its disguising financial independence through frugality while earning high income, non-repeatable black swam type events, or having access to rare benefits such as a pension. I don’t think one should apologize for their success but they should clearly address these advantages.

The way I see it we should all be immensely proud of our accomplishments. We begin the race at different starting lines but we all must work hard to reach the finish line. Some of us have to work even harder because we begin from farther back. This doesn’t minimize the effort of any parties, but it does help us those who want to follow in our footsteps. They can see just how far they really have to go. Thanks for the comment!

This is why with every financial update I try to remind my readers that I have a high income and about the various financial advantages I have, like no kids (and the fact that I’ve jettisoned the spender husband). That makes a huge difference in results, even if you’re comparing me to a parent who makes the exact same amount that I do. Huge difference once you add in kid expenses. I also remind them that I have an incredibly low mortgage. All of these things are important because it’s natural to compare yourself to any results you read about and readers need to be reminded that situations vary greatly. And more importantly perhaps that I know this and am not saying the dreaded “if I can do it, you can too!” — ugh!

I think that’s an excellent point. A big part of this is the tone of what bloggers say and how they come across to readers. There is a lot of ‘this is easy’ I did it nonsense that fails to take into account the whole situation. Thanks for the comment.

Hi! I’ll jump in with a comment since you happened to have my specific circumstance as one of your questions (“Should a blogger say we should work part time without acknowledging that his or her spouse works a full time job?”).

I wanted to start a blog for years before I finally did, and in that time I read and reread all kinds of blogging advice. I identified my intended audience as married and degreed working moms who are conflicted about time at work because they want more time with their kids. I started my blog to write about having a part-time career as a great compromise in the quest to “have it all.” I think it was Kassandra D. who wrote a post about doing no harm with our blogs. So, yes, I think I owe it to my audience to be clear that I have a husband who is the primary breadwinner and that is why I can afford to work less. This was especially true in our younger years when our cash flow was much tighter.

I also aim for one main point per post, and my biggest problem is that I am slow to write/publish and it’s taking me too long to get my whole story out.

Quick follow-up: I HAVE been transparent about my husband. My last point was a reference to writing about the challenges of a part-time career. I haven’t gotten to all of those yet!

Thank you for the comment. Having the ability to work part-time is an amazing option. It’s one I plan to explore in another year when my youngest heads to kindergarten. We have reached FI, but I still think it’s important to point out that my husband earns six figures. It makes a huge difference in what I choose to do with the next ten years. Thank you for being so honest. I think the danger comes when we write from the perspective that everyone should work part time or stay at home with their kids. Some people can cut back to make that happen, but many don’t really have a choice. My choice was dependent on the money we saved prior to the birth of my first child and my husband’s ongoing income. If my husband or I had different jobs with different income levels we wouldn’t have reached FI as early as we did either.

I have to admit the many individuals with successful blogs who claim to have realized FIRE and are “living off passive income”, but, in fact, clearly live off their blog income, royalties, coaching fees, published articles, etc. and reinvest their dividends–do strike me as being somewhat disingenuous. Yes, they might say at times that they are still working in a sense, but draw a distinction by saying they are no longer “working for the man” but for themselves. Well, as someone who has mostly been self-employed by entire working career, I don’t really get that distinction. If you are working hard, meeting deadlines, hosting meetings, under the pressure to publish, etc, that sounds like work to me, be it a W2, 1099 or any other form of compensation. My solution is to simply drop the “RE” and say you’ve achieved “FI” and define what you mean by that.

I think this is one of those cases where the word travels on a slippery slope. When we think about RE part of fire we think about not working. The new definition is quitting a conventional job in order to do ‘other’ work. But you raise an interesting point. If you are already working in an unconventional job and have been all along you are not retired. So how come one guy can say he’s retired and the other can’t? I think this is one of those cases where your view point alters the definition and I can definitely see how it feels like dishonest to you. Thank you so much for your comment. I have never thought about this issue from that point of view. I also agree that we should just use FI if you want to keep working and cut out the RE part.