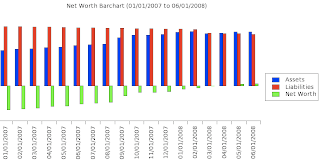

The image above represents our current net worth including the liabilities on our mortgages but not including the value of our homes. According to the graph above if we cashed in all of our investments today my husband and I would have just enough money to pay off our mortgages. I removed the actual dollar figures for reasons I have discussed at length in previous posts, but you can clearly see that the green net worth bar is now slowly moving up, while the red liabilities bar begins to inch down.

The image above represents our current net worth including the liabilities on our mortgages but not including the value of our homes. According to the graph above if we cashed in all of our investments today my husband and I would have just enough money to pay off our mortgages. I removed the actual dollar figures for reasons I have discussed at length in previous posts, but you can clearly see that the green net worth bar is now slowly moving up, while the red liabilities bar begins to inch down.

In reality, although our assets are now greater than our liabilities, we couldn’t exactly cash out and pay off our mortgages. The majority of our investments are stored in retirement accounts, which would incur hefty taxes and penalties if we sold them. I don’t want to work out a whole bunch of fancy math to figure out just how much we would need to pay off our mortgages in full, the important thing is that dollar for dollar our assets have surpassed our remaining liabilities. Plus we would never sell off everything to pay our mortgages, but it’s nice to know that we could if for some reason we needed to.

I am very much looking forward to the day that my net worth moves from red to black!

It probably wont be for a while, especially if I buy a house before I pay off my student loans…but we’ll see!

@graduated learning — just remember slow and steady wins the race. Good luck meeting your goals.

Congrats — that says something given the size of the mortgages you have (esp on the beach house).