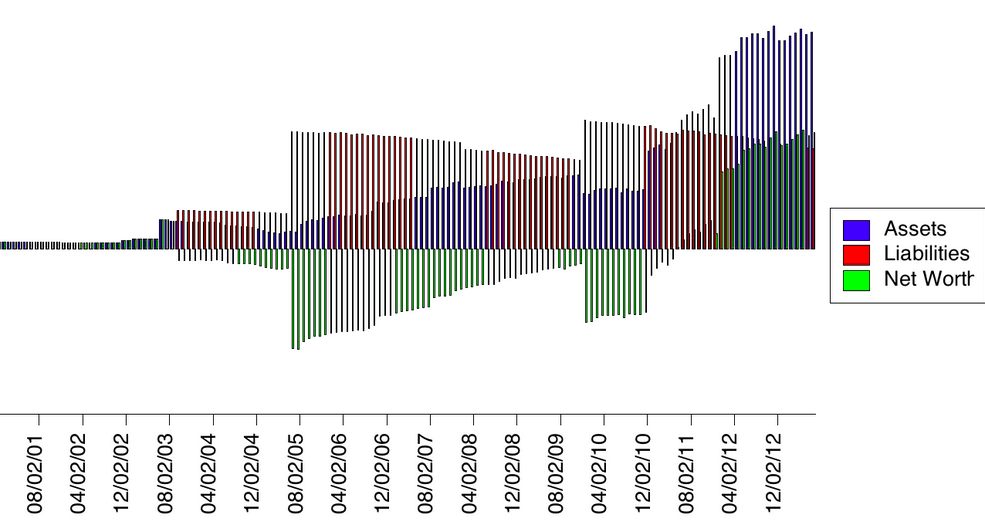

My husband sent me this snapshot of our current net worth bar chart. I left out the actual numbers, but you can get the gist of our progress without knowing the specifics. In 2011 our net worth reached positive status and since then it has remained steady and strong.

It hasn’t grown in leaps and bounds since that time, but in 2011 I left the working world to stay home with my son, so we knew the rate of growth would slow. In fact I was terrified of what would happen to our finances after that decision and I’m so happy to see that while the numbers aren’t ticking up rapidly they aren’t falling dramatically either.

A big reason for our continued progress was my husband’s decision to form his own company. While I stopped earning a significant paycheck his pay increased enough to cover my losses.

I love watching that chart grow!

It should be noted that this graph does not include real estate as an asset. That often skews perception of net worth… Just because you “bought a house” doesn’t mean you own it. In fact your lender owns 99% of it and you pay them back for the next 15-30 years to stay in it.

For the purposes of Net Worth calculations I like to include mortgage liabilities but exclude real estate assets. This chart reflects that notion…

Do you use excel to track your net worth?

I made my own spreadsheet for assets that I update monthly because I haven’t been able to find any good templates to track net worth or assets. I’m not 100% satisfied with it because I know that it could be so much more, I just haven’t invested the time to add all the features I’d like to have.

We use gnucash to track everything. I’ve written about it a few times before: https://www.onefrugalgirl.com/keep-your-finances-on-track-with-the-help-of-technology/. It’s not the easiest software to use.