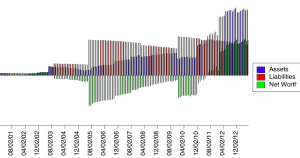

A long time ago my husband and I consolidated all of our accounts into one bank. We rolled all of 401ks into IRAs and acquired access so that we can view each others retirement accounts. When we log into our bank account we can now see each and every dollar we’ve saved and just how much it’s increased or decreased as the days and months pass by.

After entering a user name and password we can see a total of our net worth minus the properties we own. For the record I don’t include cars, jewelry and other such things in my net worth. I include money in the bank and real estate; nothing else.

Having everything in one place certainly makes things easier, but could it also be saving me money? I hadn’t thought much about it until a friend forwarded me this link. I did not pay to read the entire study, but the abstract states:

The decision to save enhances well-being in the long-term but it conflicts with the desire to spend money to gain immediate gratification. In this research, we examine the influence of having single versus multiple accounts on individuals’ savings and spending decisions. We find that individuals save more with a single account than with multiple liquid accounts. Utilizing work on motivated reasoning and fuzzy-trace theory, we suggest that multiple accounts engender fuzzy gist representations, making it easier for people to generate justifications to support their desired spending decisions. However, a single account reduces the latitude for distortion and hinders generation of justifications to support desirable spending decisions. Across four studies that provide participants with the opportunity to earn, spend, and save money, we demonstrate the proposed effect and test the underlying process.

Perhaps it is easier to overstate your net worth when money is placed in multiple accounts. When money is not co-located you must add the funds from each account in order to decipher just how much money you have. If you don’t manually add the figures together you may create a fuzzy estimate of your overall worth.

I think this makes perfect sense. Without looking at a concrete figure you create a ballpark estimate in your mind and then decide whether or not you have enough money to spend on the items you want. I can see how it would be easier to spend money without that black and white figure staring back at you.

Over the years I’ve found that the more I save the more I have a desire to save. That’s because I can log into my bank and see the progress I’ve made to date. If you save $100 in one bank and $100 in another the numbers don’t look nearly as impressive as saving $200 all in one place. It seems silly, but it’s true.

Looking at that $200 number will provide the incentive to continue setting aside money. As the number grows so does your sense of achievement. The more money you save the more accomplished you feel.

I never thought about the correlation between consolidated bank accounts and saving money, but the more I think about the more it makes sense. For the record, sites that provide a snapshot of your bank accounts could probably provide the same value.

What do you think? Do you think consolidated bank accounts and snapshots of net worth would help you save money?