I can’t seem to avert my gaze from the balance on my retirement accounts. I know that I’m young and that I have plenty of time for the market to regain speed, but I am still amazed to see thousands of dollars wiped out of my accounts in a matter of days.

My husband and I are still contributing to our retirement accounts and we haven’t changed any of our allocations or sold any stock or mutual funds. We’ll hang in there and wait until the market rebounds, which it is inevitably bound to do.

As I look at the decreasing balance I can’t help but think of a financial advisor I met with a year or two ago. He said a lot of individuals invest too aggressively. He said most investors think they can stomach a very large storm, but in truth very few can bare to see their hard earned dollars dwindle before them.

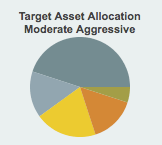

He tried to convince me to think about paring back our holdings. He wouldn’t give me any specific information on stocks or mutual funds unless I paid him, but he did tell me too think long and hard about targeting a moderately aggressive portfolio. He said, “what if you saved $1 million and then watched it shrink in size by half”.

Well we don’t have a million dollars in our accounts, but I will admit that it is harder to watch those accounts shrink then I thought it would be.

Thankfully I only had $500 in my 403b to begin with. It’s times like these that I can appreciate how my many years in college left me broke.

I know this probably doesn’t help much, but realistically the growth over the past number of years probably shouldn’t have happened at the level that it did. So a lot of what’s lost was a correction — although if it’s your ‘earned’ money that’s being corrected, it still feels horrible.

I cannot bring myself to look, as I am pretty sure that almost half was wiped out. However, I figure that as long as I still have everything I’ve actually put in myself – or my employer has – regardless of any interest, then I’m still ok. That, I think, is still true. But it still hurts.

It WILL come back and you have plenty of years until retirement. Stop stressing. In fact, if you think of it the market is on SALE. I’ve put an extra 2K into my retirement accounts in the last month – won’t I be happy 30 years from now?

I’m 32 and my 403b is allocated to 90% equities and my Roth IRA is 100% equities. I’m not having a problem with this big stock market correction at all. In fact, I just increased my contributions to my Roth IRA. The people that can stomach these downturns are the ones that will benefit the most from them.